AITEX Summit Fall 2025 – Image | AITEX Summit

This November, top IT professionals from around the world will put their skills to the test in a global AI sprint. AITEX Summit Fall 2025, taking place online November 1–2, is organized by AITEX, the Association of Information Technology Experts, a California based community that brings together technology leaders across the United States, Europe, and the CIS.

AITEX members have led major projects, published in leading journals, and hosted international industry events. That record of excellence gives the Summit its credibility and sets a high bar for participants.

Over 48 hours, teams will move from concept to prototype, with submissions reviewed by judges recognized for their expertise and influence.

Why Credibility Matters in AI Today

AI is advancing at a rapid pace. It shapes how companies work, how services are delivered, and how industries adapt. With so much attention on the field, it can be hard to separate hype from real progress.

AITEX addresses this by setting higher standards. Participation is limited to IT professionals, and judges are held to strict qualifications. This ensures that every idea is grounded in expertise and built for real-world application.

The result is more than a hackathon. AITEX Summit is a forum where innovation is measured against professional benchmarks.

Judges Chosen Through Rigorous Standards

AITEX’s credibility begins with its judges. Each member of the panel is vetted against three core criteria: demonstrated impact on the IT profession, a substantial body of professional work, and recognized standing in the technology community. This framework ensures that evaluation is consistent, fair, and rooted in proven expertise.

For the Fall 2025 Summit, the panel brings together top professionals from more than ten countries. It includes AI specialists, software architects, UX leaders, entrepreneurs, and policy experts. Collectively, they represent the breadth of the IT profession and are equipped to review projects from both technical and practical perspectives.

How Projects Are Evaluated

Every project is reviewed against clear and transparent criteria. The breakdown ensures that both technical skill and broader impact are considered.

- Innovation and originality (25%): Teams are rewarded for bringing forward new ideas and creative applications.

- Technical implementation and AI utilization (25%): Projects must demonstrate proper use of AI and robust engineering.

- Real-world impact and scalability (20%): Solutions should show potential to expand beyond the prototype.

- User experience and design (15%): Interfaces and interactions must be practical and user-friendly.

- Presentation and documentation (15%): Teams must clearly explain what they built, how it works, and why it matters.

This balanced system encourages participants to combine imagination with execution. The result is projects that are not only inventive but also ready to grow beyond the event.

Who Can Join: Rules for IT Professionals

Eligibility requirements set AITEX apart from open-entry events. Participation is limited to working IT professionals who are at least 18 years old and can demonstrate relevant education or several years of experience in the field. Competitors are expected to have skills in areas such as AI, machine learning, software development, or data science, ensuring that every project reflects genuine expertise.

Registration is free, but teams must be finalized by October 25 and include no more than five members. Participants may not join multiple teams, though groups can be fully remote and span different countries.

Four AI Tracks to Shape Real-World Solutions

Participants select one of four focus areas:

- AI for Good: Education, healthcare, sustainability, accessibility, and community projects.

- AI for Business: Automation, analytics, customer experience, productivity, and financial innovation.

- Creative AI: Generative AI for art, music, design, gaming, and storytelling.

- Open Innovation: Research-driven or experimental ideas that do not fit traditional categories.

These tracks reflect the breadth of AI’s impact, ensuring that the Summit covers both technical and social applications.

A Two-Day Sprint to Build, Test, and Deliver

From November 1 to 2, participants have two days to design and deliver original projects through the Summit platform. Teams must create prototypes during the official timeframe and cannot reuse previous work.

The compressed timeline is a deliberate choice. It forces teams to focus, prioritize, and present results quickly. Success requires striking a balance between originality and technical execution, producing a project that demonstrates clear potential.

This structure reflects how innovation often occurs in the real world, where deadlines are tight and results must be demonstrated quickly and effectively.

What Participants Gain

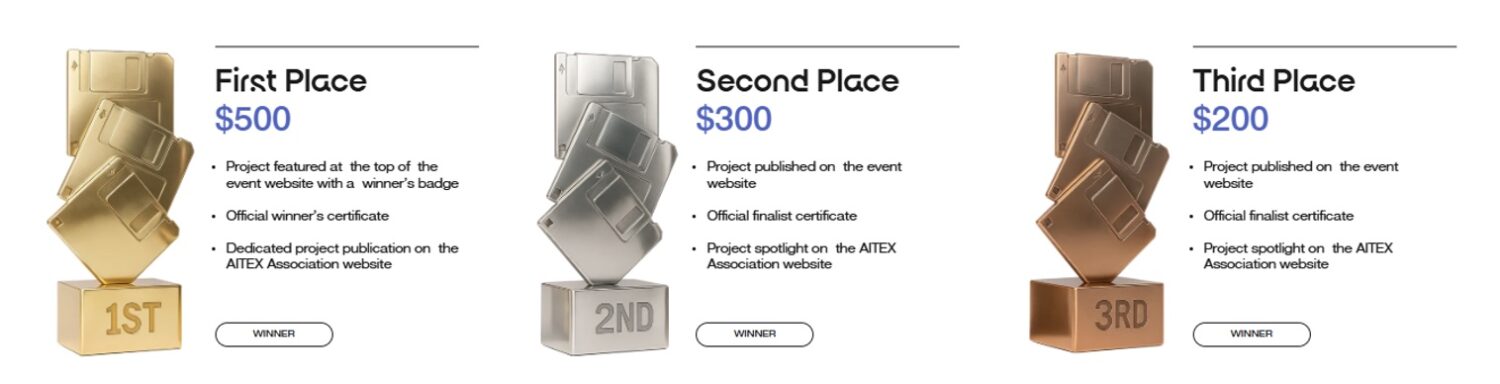

Awards for the AITEX Summit Fall winners – Image | AITEX Summit

Three top prizes are awarded to the best teams, along with certificates and public recognition. Judges are also honored, underscoring the credibility of the process.

Beyond awards, participants gain exposure to a global network of peers, employers, and partners. Evaluation by respected professionals strengthens portfolios, while feedback helps refine projects. For companies, strong performance signals reliability. For individuals, it offers visibility and career growth.

Free, Global, and Backed by Industry Leaders

AITEX Summit Fall is free to enter for qualified professionals worldwide and supported by leading tech companies and research institutions. Their backing ensures the event remains inclusive while upholding high professional standards. This balance of access and rigor makes AITEX a unique institution.

How to Take Part

Registration opens on October 1. Once confirmed, participants may compete individually or form teams of up to five. Pre-event preparation may include research and practice, but coding or design work for the project must begin only after the official start.

During the competition, teams are expected to submit a prototype along with supporting documentation that explains the challenge addressed, the methods used, and the expected impact. Submissions must be completed and delivered by November 2.

Register now to secure your spot and join AITEX Summit Fall 2025.

Key Dates for AITEX Summit Fall 2025

- October 1, 2025: Registration opens

- October 25, 2025: Team formation deadline

- November 1, 2025: Summit begins

- November 2, 2025: Submission deadline and winners announced

A clear timeline keeps the competition transparent and fair for everyone involved.

AITEX Summit Fall: Shaping the Future of AI

AI continues to redefine industries, communities, and daily life. For AI to deliver value, however, it requires professional environments where ideas are tested, evaluated, and refined. AITEX Summit Fall 2025 provides that environment.

The Summit brings together qualified participants, a judging process built on strict standards, and a format that values practical outcomes. It is a forum where real expertise is recognized and where projects are given the chance to demonstrate genuine impact.

This November, AITEX Summit Fall will spotlight AI innovation and the professionals driving it forward. To take part, visit aitexsummit.com.

Advertising disclosure: We may receive compensation for some of the links in our stories. Thank you for supporting Irvine Weekly and our advertisers.